In the previous section, we have thrown light on the sixth step of starting a business- Finding a Mentor. A mentor plays such a major role in taking you through the path of success and his prominence cannot be undermined. But you cannot run a business without the money and raising initial funding/ money is the toughest task as you don’t have sufficient contacts and most importantly your business is not operating. Here in this section, I have mentioned about Seed Funding, Crowd Funding and Bootstrapping Finance for raising initial money for a business/ startup.

However, let us understand a broader aspect of Funding first. ‘Funding’ is primarily a means of providing financial resources, in the form of values like money, effort or time to finance a startup. This funding can be provided by a government, an organization or an individual investor. Most of the time, entrepreneurs feel the passion for establishing their own startups but most of their initial hiccups to comprehend the right time to do so boils down to ‘Funding’.

Now let’s discuss all the types of initial funding and know why bootstrapping is the best way to raise the initial funds in the eyes of mentors:

Crowd Funding

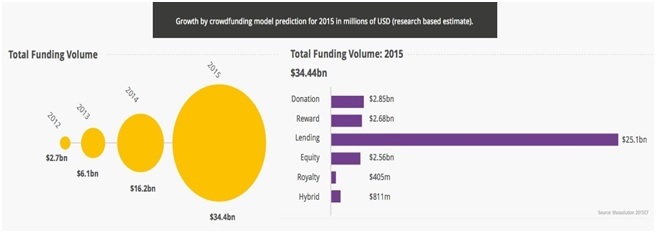

The newest initial funding technique on the block; crowdfunding is the practice of funding a venture by raising small amounts of money from a large number of people, usually using the internet as a medium. Crowdfunding has emerged as a blessing in disguise for many startup owners who are in the process of seeking funds for their venture. In 2015 itself, over US $34 billion was raised through crowdfunding as initial funds for the startups. Additionally, sites like Kickstarter and Indiegogo have made the whole process easier and highly accessible to even amateur business enthusiasts. The World Bank has estimated the Crowdfunding technique to reach $90 billion by the end of 2020.

It works on a simple principle. An entrepreneur feeds in a detailed description of his business in an attempt to seek contributions from a large number of people online. On platforms like Kickstarter, he highlights his short-term and long-term goals, his target audience, future strategies for turning his business into profit, how much funds is he looking for and who he plans to utilize those funds for his business. A consumer can read through the entire details and offer to pay money to help him. Usually, the ones who offer do it altruistically in the form of donation or sometimes they seek some form of a reward like any gadget. Crowdfunding is spread across various funding channels like donations, rewards, equity and debt. If you are trading your equity for raising money then be very clear about your terms and conditions.

One setback of Crowdfunding is that this is not a sure shot method to ensure that your business will receive funding especially if you are in the service industry. In such a competitive startup landscape, one has to ensure that your description entices the consumers and your business idea is really unique enough to pull the attention of the potential consumers. On a crowdfunding site, you, as an entrepreneur, are the face of your story so you need to portray yourself in a way that the consumer is impulsive to extend his funding support to your business.

Seed Funding

Seed funding is one of the most common techniques for initial funding. It is a form of securities offering in which an investor invests capital in exchange for an equity stake in the company. An extended form to Seed Funding is Venture Capital financing with the only difference that it is provided after Seed funding to early stage yet high potential growth startups. While Seed funding is provided when the company is at the fledgling stage, venture capital is provided during the growth stage of a startup.

A venture capital investor is a group of professionals who solely look for startups to help them with funding. The VC firms have a lot of money to offer to startups in addition to plenty of other resources. However, with a large sum of money involved, their expectations from the startups are no less either. They look for startups that are a bit more stable and have a strong team to operate.

The biggest limitation of getting seed funding from angel investors or VCs at this stage is that they ask for large equity and control in decision making as your business is not a revenue generating machine as of now. If you will lose your major equity initially then chances are you might be replaced by someone else as the CEO within 5-10 years and I hope you don’t want that being the founder.

Bootstrap Finance

It is the best way of raising initial funds. In Bootstrapping, a business founder attempts to build his company from his personal finances or from the little capital from known ones; mostly relying on money other than outside investments. At times, founders rely on pre-orders for their products and use those funds to build those products and then deliver them. Because most of their company’s development stems from internal cash flow, these founders are very precarious of their expenses. The amount is usually borrowed from people who are already known to the business owner and there is an element of trust on the basis of which they offer to help them financially.

As far as the initial funding for a startup is concerned, bootstrap is the most convenient method. It involves less money that is borrowed with lower interest rates. Also, the entrepreneur is able to retain control over his venture for all his decisions. However, this method also involves an increased level of financial risk on the entrepreneur and also has a restriction on the amount that is funded, as sometimes that amount might not be feasible to ensure a high rate of startup success. Nonetheless, in further sections, we will discuss more on why Bootstrapping is the most effective funding technique that all startups need to consider.

Why Bootstrap your Business for Initial Funding?

1. One of the most important advantages of Bootstrapping is that unlike other funding techniques, the control and decision making lies solely with you, with no case of investors seeking a piece of you.

2. Also, it is a less time-consuming process in contrast to Angel Investing or VCs as there will be not much need for endless meetings and spending time on presentations, trying to convince them how and where you will use their money.

3. Plus, you tend to become more responsible in spending the funds received in the most critical and thoughtful way as these funds have been granted to you on the basis of trust that you have formed with them over the years. So apart from the finances, your personal trust and reputation can be jeopardized, which is certainly not what you are aiming at.

4. Bootstrapping also inculcates in you the ability to use funds judiciously and come up with cost effective ways to find solutions, as you are in a crunch for finances and the money is not flowing your way through large investment companies. Ultimately, your creativity increases here and you begin to unearth your inner talent that you might not even be aware of, at first.

Whom to Approach for Bootstrapping Finance?

Usually, bootstrapping begins with some personal savings or some amount borrowed from friends and family. People who trust your abilities and are ready to extend financial assistance in your venture without expecting any market share are the ones more likely to bootstrap. At times, the founder finances his own company while working on a day job to support his side business.

One can even approach your regular customers provided you have a good reputation in the market and your business has kicked off. In this case, customers can pre-order their products and pay in advance and you can use that money to make and deliver the product to you. Trust is highly important in bootstrapping because most often, these people do not even look for any business model and simply provide you financial support in the hope that you are not letting them down or engaging in unscrupulous practices.

How to Convey for Bootstrap?

While approaching people for bootstrapping, one needs to be very cautious because of the high level of trust involved. Somewhere in between, the element of personal connection gets involved and your reputation is at stake. Also, the ones who are bootstrapping your business are not professionals and might not be aware of various business tactics. They might just be people around you ready to help you because of the personal connection you share with them. So it is advisable to approach them exuding a great amount of confidence. It is your responsibility to rid them out of their fear and inhibitions and make them believe that their money is in safe hands and will be utilized in the most productive ways.

When not to Bootstrap Your Business?

There is no doubt that bootstrapping is a convenient option to fund your startup business. However, since the money funded comes from people around you who often do this voluntarily and on the basis of trust, don’t expect the amount funded to be really huge in all the scenarios. Avoid bootstrapping when you know that a small amount would not be sufficient to sustain your business. In this case, you might have to explore other funding options like opting Seed funding.

Also, when you know that your business model cannot guarantee you immediate revenue and it would take quite some time for your business to reach the break even stage just like for companies like OYO Rooms and Quora, avoid seeking Bootstrap financing. This is because the money that has been invested by people who trust your abilities need to be returned as soon as possible owing to personal equation involved here.

Also, since ‘trust’ is the most determining factor for you to be able to fetch investment, in case you have a not-so-good reputation in the market, your chances of getting investment drops down heavily. In such cases as well, you can bypass this option and look for other investment alternatives. Bootstrapping requires that the founders should possess skills of networking, constant innovation and adaptability to thrive in the market. One needs to be passionate enough as a high amount of risk is involved especially when the cash is not sufficient. In spite of stretching their limited resources far too much and doing all it takes to make things happen, the chances of making it big in five years are still 50-50.

Do’s of Bootstrap

Startup owners who are looking for their business to be bootstrapped need to have a different mindset than the ones opting for VC or angel investor. The basic bootstrapping rules vary depending on the amount needed for investment, the country of business operation and relationship a business owner shared with people from whom investment is expected. Here are some do’s and don’ts that need to be adopted by them to keep their business floating:

-

Focus on Profits and Invest Them

Bootstrapped companies have no pile of investment that they can spend easily so they need to be financially prudent to avoid any money being wasted. They need to focus on their profits as this profit would act as a revenue source for further funding of your business. Bootstrapped companies need to develop well-paying customers in order to keep payrolls flowing, paying their bills and be able to fund the company’s growth all from the company’s earnings. The thin line between spending and investing needs to be achieved.

-

Start Your Operations Soon

Bootstrappers need to start their business operations and enter the market quickly even if it involves some aspects of limitations involved. Focusing on a small market saves your business from large scale competition. However, once they have caught hold of the flow of their business, there would be no dearth of opportunities for them that they can grab as and when the time is right.

-

Bring Out the Best of the Available Resources

Bootstrapping exposes the company to sustainable yet limited resources to keep the business intact. So, it is important for your employees to be adept in decision making on the basis of those limited resources. This practice should be followed by the top management first and then your employees can follow the league. Doing this helps the company to scale efficiently and respond to any adverse conditions that may arise. Being the founder it’s your responsibility to train everyone to bring out the best with the available resources.

-

Seek Quick Break Even, Cash Generating Projects

Unlike big companies with large investment involved, a bootstrapped company does not necessarily have to stick to a particular strategy. Grab any feasible profit opportunity because, at this stage, all that matters is that your business is making money that builds credibility in front of your suppliers, customers and employees.

Don’t’s of Bootstrap

Now let’s discuss some don’t while going for bootstrapping as an initial fundraising method

-

Don’t Underestimate the Power of Budgeting

The approach to bootstrapping might not be the same for every entrepreneur as some of them might still be working full time, some might have co-founders while the rest would be doing it all by yourself. However, the ground rule that one should not forget is to make a business plan. This would help you in keeping track of your expenses and you will be able to be stringent when it comes to spending. Every founder will have different means of budgeting, while some of you would rent a small space in your home and convert it into your workspace, others might cut down on personal expenses or utilize the funds accumulated from the previous venture.

-

Don’t emphasize on Doing it Alone

While we are not suggesting to make it a necessary condition, but having a co-founder, especially when your business is in need of bootstrapping can be really advantageous. It will help you in splitting the costs in addition to sharing roles and responsibilities. You can also learn complementary skills and the probable financial risk of doing business also gets divided amongst the two founders involved.

If you are having doubts, queries or you want to share something then you can comment in the below section. Read Next Step.

0 Comments